Last September, Vietnam once again missed the opportunity to upgrade its stock market ranking by FTSE Russell. It is known that currently, there are 3 major market rating organizations in the world, including MSCI (Morgan Stanley Capital International), S&P Dow Jones (Standard & Poor’s), and FTSE Russell (Financial Times Stock Exchange).

These organizations evaluate market rankings annually and classify stock markets into 3 levels. That is:

– Developed Market: This is the most attractive market for investors, because it has all the conditions to develop the market and economy, and the ability to access high foreign investment capital, good scale and liquidity.

– Emerging Market: Ranked higher than frontier markets. In this market segment, investors have greater access to foreign capital, improved liquidity, and expanded capitalization scale.

– Frontier Market: This is the stock market with the lowest MSCI index. The characteristics of this market segment are that it is in the development stage and has just accessed foreign investment capital.

Vietnam’s Stock Market ranking is at the lowest, which is Frontier Market. For many years, Vietnam has been immersed in this lowest position. When upgraded to the stock market, the opportunity to attract investment increases, especially with foreign capital sources.

And that is also a quantified index, to let investors know the level of safety when they want to spend money on transactions in this market. In general, the higher the ranking, the more difficult it is for manipulators to get in, and the less risky investors are.

The fact that Mr. Nguyen Phu Trong arrested the tycoon manipulator of the stock market, Trinh Van Quyet, could not help upgrade the market. If you want to filter out dirt, you have to filter it from the source, you can’t just skim a few pieces of trash on the surface and that’s it.

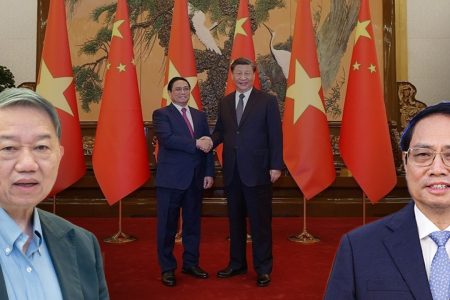

To be upgraded, Prime Minister Pham Minh Chinh must set a policy to increase the market score. Starting from the criteria set by rating organizations, if meet, the Vietnamese stock market will also be cleaner, more reliable and safer for investors.

Currently, we have received information that there are many “tycoon manipulators” operating very strongly in the Vietnamese stock market. One of them who can be mentioned is tycoon Tuan – Chairman of the group whose English name is translated into Vietnamese as “Sunlight Group.” Currently, this tycoon is still manipulating investors in the stock market, in the same way as Trinh Van Quyet, and in the real estate market. This tycoon is still alive and well, but has not yet been touched by the General Secretary’s iron hand.

The arrest of Trinh Van Quyet, Do Anh Dung and Truong My Lan has not yet resolved the problem of manipulation in the Vietnamese stock market. Because here, there are many tycoons who are the same like those who were arrested. If General Secretary Nguyen Phu Trong continues to act strongly, it is likely that the Vietnamese stock market will collapse. But because of mercy, the operating method in the Vietnamese stock market has not improved.

There are comments that PM Chinh and Minister of Finance Ho Duc Phoc are not without effort, but rather have limited capacity. They know that organizations set clear criteria, but they never get it done. Whether the Prime Minister or the Minister of Finance, there is no way to eliminate all the interest groups linked from the State Securities Commission to the giants, to create loopholes for manipulators.

Similarly, the General Secretary can only kill a few “small manipulators” in the stock market to make a splash, but cannot change anything. Under the management of PM Chinh, new stock market manipulators will appear.

Thoibao.de (Translated)